Talking to kids about the value of money

Posted by siteadmin on Thursday 14th of July 2022

After seeing their six-year-old son’s birthday list, Liz and Dan have realised it’s high time they started teaching Archie about the value of money. It’s true they both have reasonably well-paid jobs and only the one child but, even so, a Saint Bernard puppy, a quad bike, a horse and a life-size dalek don’t come cheap. So, what can Liz and Dan do to ensure Archie doesn’t end up bankrupting them before he goes to high school?

Pocket money

Archie is nearly seven - the age when most parents start giving their children pocket money, accordin...

Is opting out of a workplace pension a false economy?

Posted by siteadmin on Thursday 7th of July 2022

Rachel is a 35-year-old charity administrator. When she started her current job nearly six years ago, she was automatically enrolled into her workplace pension. Auto-enrolment for workplace pensions was introduced in the UK to encourage more people to save for retirement. It means employers have to enrol into a pension any workers who are:

- Not already in a pension

- Between the ages of 22 and the state pension age

- Earning more than £10,000 a year

- Working in the UK

Rachel was happy to be enrolled into her workplace pension when she joi...

Budgeting tips for saving money while making your life better

Posted by siteadmin on Thursday 30th of June 2022

Whether you want to go on holiday or just want to save some money for the future, budgeting is a good way to put aside some money for reaching this goal. Here you can find some tips to help you take control of your finances.

Why is budgeting so important?

You might think that it’s not worth to spend that much time with counting all your income and expenses. But if you use apps or spreadsheets to make it visible how much you earn and spend on average every month, it will pay off.

In case of the unexpected or just having a big expense, it’s...

How might rising interest rates affect your mortgage?

Posted by siteadmin on Thursday 23rd of June 2022

The Bank of England has raised interest rates which means bigger mortgage bills for some homeowners.

Since December 2021 the Bank of England raised interest rates from 0.1% to 1.25% to combat soaring inflation.

This move will have a knock-on effect as mortgage lenders raise interest rates in response, which will increase monthly payments for some borrowers.

What does a rise in interest rates mean for your mortgage?

Anyone without a fixed-rate mortgage is likely to see their borrowing costs rise, although how they are affected will depend...

Funding your child's university education

Posted by siteadmin on Monday 13th of June 2022

Sarah and Andrew’s 10-year-old twins, Isabelle and Isaac, couldn’t be more different. While Isabelle is boisterous and full of beans, Isaac is gentle and reserved. The children do have one thing in common though - they’re both extremely bright and they already know exactly what they want to do when they grow up. Isabelle loves animals and wants to be a vet; and Isaac is a very talented artist and has his heart set on art school.

When they found out they were getting two for one, Sarah and Andrew couldn’t have been happier. But bringing up t...

Pension planning for the self-employed

Posted by siteadmin on Tuesday 31st of May 2022

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer.

Of course, saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, who might automatically benefit from a workplace scheme and employer contributions. We’ve outlined some key points below for you to consider:

Don’t rely on the State Pension

Whether you’re employed or self-employed you’...

First steps to investing

Posted by siteadmin on Tuesday 17th of May 2022

There is no right time to begin investing but there are some decisions to make that could affect your returns. If you are 7 years old and saving your pocket money for a PS5, 17 saving the money from your first job for a car, 27 saving for your first house or 57 and finalising your retirement plans which include a dream holiday, we can provide personalised advice for you.

Angela was looking at ways she could reduce her inheritance tax. After spending some time researching, she realised she could make small gifts to as many people as she li...

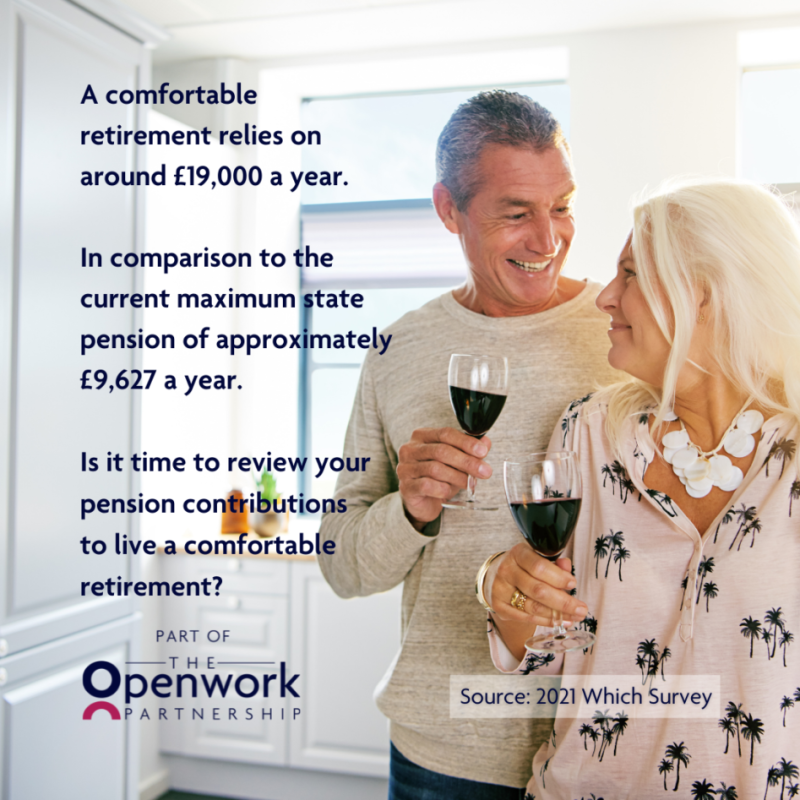

Planning for a comfortable retirement

Posted by siteadmin on Monday 9th of May 2022

Tina is a fit and vibrant 59-year-old who expected retirement to offer a whole new lease of life. She was looking forward to using her increased leisure time to explore Europe while indulging her passion for climbing. However, after going through her finances, she’s now concerned she won’t be able to afford her monthly bills let alone pay for trips abroad.

Tina has always managed her day-to-day finances really well, but she never sat down and worked out how much she’d need for a comfortable retirement. A 2021 Which survey found that a retir...

Get Savvy Against Scammers

Posted by siteadmin on Wednesday 27th of April 2022

Retired teachers Paul and Mary are devoted parents and grandparents to their three children and eight grandchildren. As their family started to grow, they decided they wanted to begin saving for their grandchildren’s future. Disappointed with the returns from their savings accounts, they decided to look into other investment opportunities. After comparing a number companies online, they settled on one and made a £30,000 bank transfer. Within just a few months, their initial investment had grown sizably.

Soon afterwards, their eldest grand...